Most Popular Side Hustles Online Posts

24 Passive Income Ideas for Earning Extra Money

24 Passive Income Ideas for Earning Extra Money

Introduction:

In today’s fast-paced world, finding ways to earn extra money without a significant investment of time and effort is increasingly appealing. Passive income streams can provide financial stability, flexibility, and the freedom to pursue your passions without being tied to a 9-to-5 job. Whether you're looking to supplement your current income or achieve financial independence, exploring passive income ideas can be a game-changer.

Disclosure: This post contains affiliate links, meaning that if you purchase something through the links below, I will receive a commission at no cost to you.

Dreaming of financial freedom? Learn how these easy passive income ideas can unlock effortless earnings and set you on the path to doing what you love.

Discover the top 24 passive income ideas that can help you earn extra money👇

Rental Properties

Dividend Stocks

Peer-to-Peer Lending

Create an Online Course

Write an E-book

Affiliate Marketing

High-Yield Savings Accounts and CDs

Rent Out Space

Create a Blog or YouTube Channel

Invest in REITs (Real Estate Investment Trusts)

Sell Stock Photos

Develop an App

Dropshipping

Vending Machines

Sell Digital Products

Automated Online Businesses

Licensing Music or Art

Create a Membership Site

Invest in Index Funds

Purchase an Existing Online Business

Sell Handcrafted Goods

Publish a Podcast

Social Media Influencing

Create a Subscription Box Service

How We Selected the Best Passive Income Ideas

Choosing the best passive income ideas involves evaluating various factors such as initial investment, potential returns, time commitment, and the level of involvement required. We considered the following criteria:

Low Initial Investment: Options that require minimal upfront capital to start.

Scalability: Potential to grow the income stream over time.

Risk Level: Balancing potential returns with the associated risks.

Time Commitment: Minimal ongoing effort required once set up.

Diverse Opportunities: A variety of methods to cater to different skills and interests.

By analyzing these factors, we've curated a list of passive income ideas that offer a good balance of potential earnings and feasibility for most people.

What is Passive Income?

Passive income is money earned with minimal active involvement. Unlike a traditional job where you trade time for money, passive income allows you to earn continuously with little ongoing effort after the initial setup. Examples include rental income, dividends from investments, and royalties from creative work.

Active vs Passive Income

Understanding the difference between active and passive income is crucial:

Active Income: This is earned from active involvement, such as a salary from a job, wages from freelance work, or fees for services rendered. It requires continuous effort and time.

Passive Income: This is earned with minimal ongoing effort. Once the initial work or investment is done, the income stream continues with little to no additional effort. Examples include royalties, dividends, and rental income.

How Much Money Can I Make With Passive Income?

The amount of money you can make with passive income varies widely based on the method chosen, the initial investment, and the effort put into setting it up. Some passive income streams can start small and grow significantly over time, while others might provide steady but modest returns. Realistically, it’s possible to earn anywhere from a few hundred to thousands of dollars per month, depending on your strategy and dedication.

Passive Income Ideas for Making Money

1. Rental Properties

Rental properties involve purchasing real estate properties that you can lease out to tenants. This investment can provide a steady income stream through rent and potential property appreciation over time. Key considerations include:

Location: Choose areas with high rental demand.

Property Management: Decide if you'll manage the property yourself or hire a property manager.

Financing: Understand mortgage options and financial requirements.

Maintenance: Routine maintenance and unexpected repairs must be factored into your budget.

2. Dividend Stocks

Dividend stocks are shares in companies that distribute a portion of their earnings to shareholders regularly. This can provide a consistent income stream. Key points include:

Dividend Yield: The annual dividend payment divided by the stock price.

Payout Ratio: The proportion of earnings paid out as dividends.

Dividend Growth: Companies with a history of increasing dividends.

Diversification: Spread investments across various sectors to mitigate risk.

3. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual lenders, bypassing traditional financial institutions. It can offer higher returns compared to traditional savings accounts. Considerations include:

Risk: Higher returns come with higher risk, including borrower default.

Platform Fees: Be aware of the fees charged by the lending platform.

Diversification: Spread loans across multiple borrowers to minimize risk.

Regulations: Ensure the platform complies with financial regulations.

4. Create an Online Course

Creating an online course involves sharing your expertise on a subject by developing structured content that students can access digitally. Steps to consider:

Identify Niche: Choose a subject you’re knowledgeable about and that has market demand.

Content Creation: Develop video lectures, written materials, and quizzes.

Platform: Use platforms like Udemy, Teachable, or Coursera to host your course.

Marketing: Promote your course through social media, email lists, and partnerships.

5. Write an E-book

Writing an e-book allows you to share knowledge or stories in a digital format. Important aspects include:

Topic: Choose a niche topic that appeals to a specific audience.

Writing: Create a detailed outline and write the content.

Editing: Hire a professional editor to review your work.

Publishing: Use platforms like Amazon Kindle Direct Publishing (KDP) or Smashwords.

Marketing: Use social media, blogs, and email marketing to promote your e-book.

6. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for sales made through your referral. Key steps include:

Niche: Select a niche that you’re passionate about.

Affiliate Programs: Join programs like Amazon Associates, ShareASale, or ClickBank.

Content: Create content (blogs, videos) that includes affiliate links.

Traffic: Use SEO, social media, and email marketing to drive traffic to your content.

7. High-Yield Savings Accounts and CDs

These financial products offer higher interest rates than regular savings accounts. Considerations include:

Interest Rates: Compare rates from different banks.

Liquidity: High-yield savings accounts offer more liquidity than CDs.

Term Length: CDs have fixed terms; choose one that fits your financial goals.

FDIC Insurance: Ensure the account is insured for safety.

8. Rent Out Space

Renting out space could involve leasing parts of your property, like a room, garage, or storage space. Steps include:

Legalities: Check local zoning laws and lease agreements.

Platform: Use platforms like Airbnb for short-term rentals or Neighbor for storage space rental.

Pricing: Research local rental rates to set competitive prices.

Safety: Screen tenants or renters and set clear rules.

9. Create a Blog or YouTube Channel

Creating a blog or YouTube channel involves sharing content on topics you’re passionate about. Steps to consider:

Niche: Choose a specific niche for your content.

Content Creation: Consistently create high-quality content.

SEO: Optimize your blog or videos for search engines.

Monetization: Use ads, sponsored content, and affiliate marketing to generate income.

10. Invest in REITs (Real Estate Investment Trusts)

REITs allow you to invest in real estate without buying property directly. Key points include:

Types: Equity REITs (own properties), Mortgage REITs (own mortgages), Hybrid REITs.

Liquidity: REITs are traded on stock exchanges, providing liquidity.

Dividends: REITs typically pay high dividends.

Diversification: Invest in a variety of real estate sectors.

11. Sell Stock Photos

Selling stock photos involves capturing high-quality images and selling them on stock photo websites. Steps include:

Quality: Use a good camera and editing software.

Platforms: Upload photos to sites like Shutterstock, Adobe Stock, or Getty Images.

Keywords: Use relevant keywords to make your photos discoverable.

Consistency: Regularly upload new photos to keep your portfolio updated.

12. Develop an App

Developing an app involves creating a software application for mobile devices. Steps include:

Idea: Identify a problem and create an app to solve it.

Development: Learn coding or hire a developer.

Platform: Decide between iOS, Android, or both.

Monetization: Use ads, in-app purchases, or a paid app model.

Marketing: Promote your app through social media, app stores, and reviews.

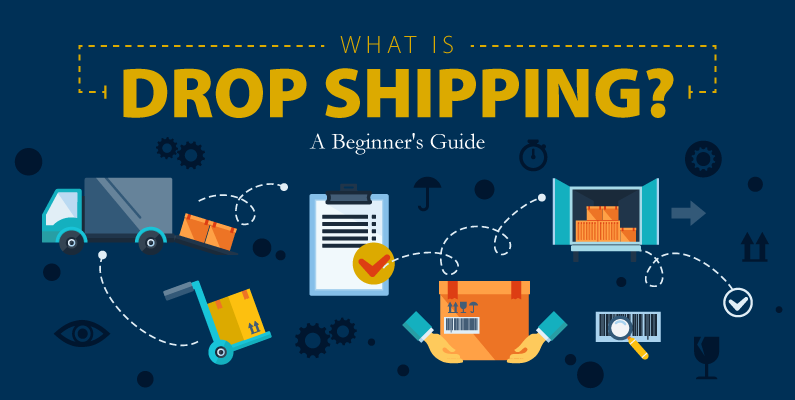

13. Dropshipping

Dropshipping is an e-commerce model where you sell products without holding inventory. Steps include:

Niche: Choose a profitable niche.

Suppliers: Partner with reliable suppliers using platforms like AliExpress or Oberlo.

Platform: Set up an online store using Shopify, WooCommerce, or other e-commerce platforms.

Marketing: Use SEO, social media, and paid ads to drive traffic to your store.

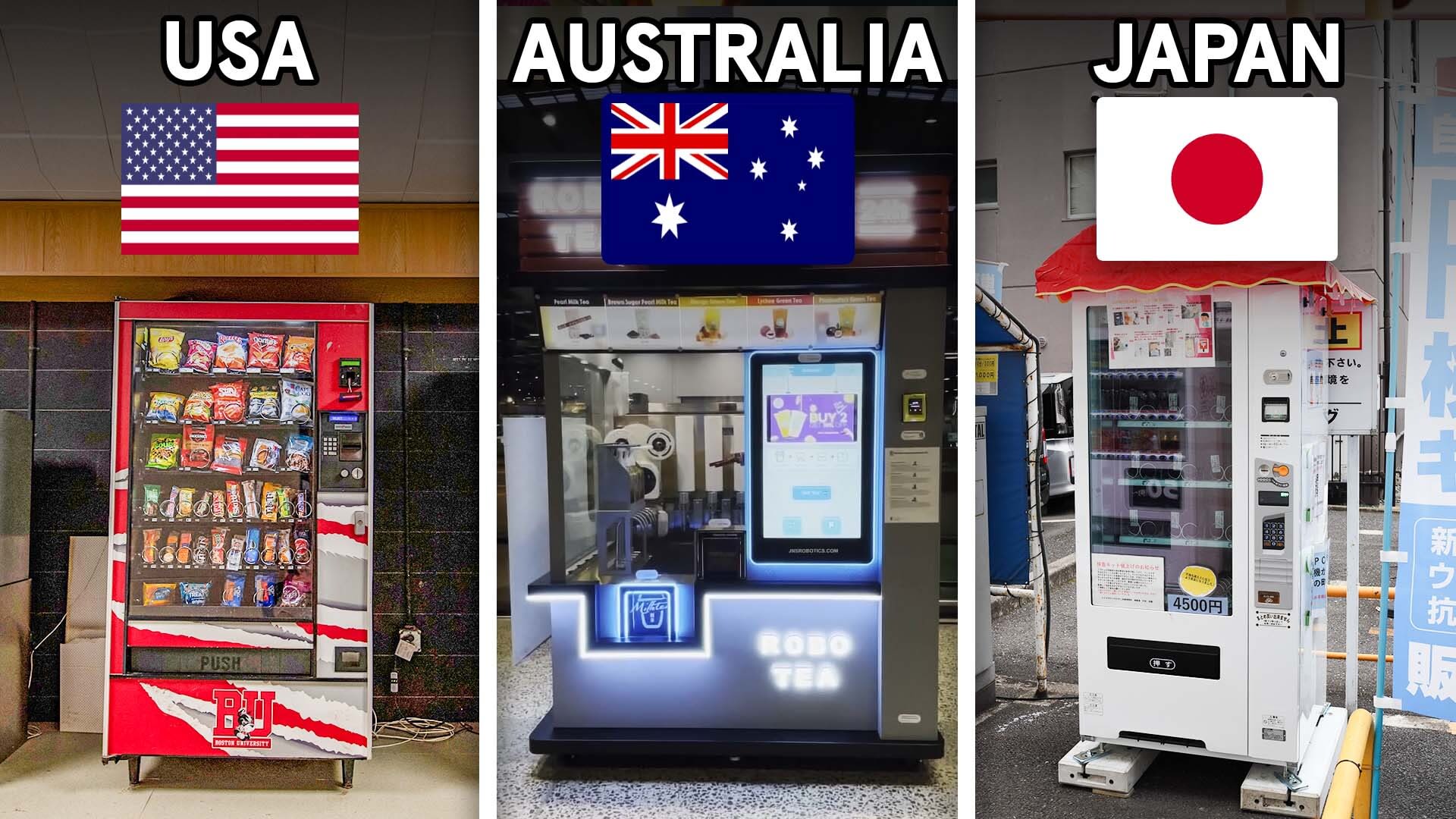

14. Vending Machines

Owning vending machines involves placing machines in high-traffic areas and stocking them with products. Steps include:

Location: Choose locations with high foot traffic.

Machines: Purchase or lease vending machines.

Products: Stock machines with popular items like snacks and drinks.

Maintenance: Regularly restock and maintain the machines.

15. Sell Digital Products

Selling digital products, such as templates, courses, or printables, involves creating digital items that can be sold online. Steps include:

Product: Create a digital product that provides value.

Platform: Sell through platforms like Etsy, Gumroad, or your website.

Marketing: Use social media, email marketing, and SEO to drive traffic.

Customer Support: Provide excellent customer service to handle queries and issues.

16. Automated Online Businesses

Automated online businesses run with minimal ongoing effort. Examples include dropshipping stores, affiliate websites, and digital product sales. Steps include:

Automation Tools: Use tools like email marketing automation, social media schedulers, and chatbots.

Processes: Create standard operating procedures (SOPs) for repetitive tasks.

Monitoring: Regularly review business performance and make necessary adjustments.

17. Licensing Music or Art

Licensing involves granting permission to use your music or art in exchange for royalties. Key points include:

Platform: Use services like AudioJungle or Shutterstock for music and art licensing.

Legalities: Understand copyright laws and licensing agreements.

Marketing: Promote your work to attract potential licensees.

18. Create a Membership Site

A membership site offers exclusive content or services to paying members. Steps include:

Content: Offer valuable, exclusive content.

Platform: Use platforms like WordPress with membership plugins or Kajabi.

Pricing: Set a recurring membership fee.

Community: Foster a community through forums or social media groups.

19. Invest in Index Funds

Index funds are mutual funds or ETFs that aim to replicate the performance of a specific index. Benefits include:

Diversification: Spread risk across many securities.

Low Fees: Typically have lower fees compared to actively managed funds.

Passive: Minimal management required.

Long-Term: Suitable for long-term investment strategies.

20. Purchase an Existing Online Business

Buying an existing online business can provide immediate revenue. Steps include:

Marketplace: Use platforms like Flippa or Empire Flippers.

Due Diligence: Thoroughly review the business’s financials, traffic, and operations.

Negotiation: Negotiate the purchase price and terms.

Transition: Plan a smooth transition to retain customers and operations.

21. Sell Handcrafted Goods

Selling handcrafted goods involves creating and selling unique items. Steps include:

Product: Create unique, high-quality handmade products.

Platform: Use Etsy, Amazon Handmade, or local markets.

Branding: Develop a strong brand identity.

Marketing: Use social media, craft fairs, and local events to market your products.

22. Publish a Podcast

Publishing a podcast involves creating audio content on specific topics. Steps include:

Topic: Choose a niche topic.

Equipment: Invest in quality recording equipment.

Hosting: Use podcast hosting services like Libsyn or Anchor.

Distribution: Distribute on platforms like Apple Podcasts, Spotify, and Google Podcasts.

Monetization: Use sponsorships, ads, and listener donations for revenue.

23. Social Media Influencing

Social media influencing involves building a large following on social media platforms and monetizing it. Steps include:

Niche: Focus on a specific niche.

Content: Create engaging and consistent content.

Engagement: Interact with followers and build a community.

Monetization: Use sponsored posts, affiliate marketing, and brand partnerships.

24. Create a Subscription Box Service

Creating a subscription box service involves curating and sending a box of products to subscribers regularly. Steps include:

Niche: Choose a specific niche for your boxes.

Suppliers: Partner with suppliers for products.

Platform: Use subscription management software like Cratejoy.

Marketing: Promote through social media, email marketing, and influencer partnerships.

Fulfillment: Manage inventory and shipping logistics.

Final Thoughts:

The diverse range of opportunities available for generating income, both online and offline, provides numerous paths to financial independence. Whether through investing in assets like dividend stocks and rental properties, leveraging digital platforms to create content or sell products, or exploring innovative models like peer-to-peer lending and automated online businesses, there is something for everyone

Choosing the right path depends on your interests, skills, and resources. Start with something that aligns with your passions and expertise, and gradually expand into other areas. With dedication and strategic planning, these opportunities can significantly enhance your financial wellbeing and provide a path to achieving your financial goals.

© 2024 AI Profits Engine